Klarna: From Start-Up to Profitability, and Its Next Big Move

A journey from skepticism in Sweden, to becoming a global fintech powerhouse preparing for an IPO in the United States

This is the first of many posts I’ll be writing about Klarna. Based in Stockholm, I’ve followed the company closely since its inception, watching it grow from a local startup into a global fintech leader. Over the years, I’ve been deeply involved as an investor in fintech, across both private and public markets. With Klarna recently filing for an IPO in the US, I couldn’t resist starting my coverage early.

In this post, I’ll dive into Klarna’s story, how they generate revenue, and their cost structure. In future posts, I’ll explore these topics in greater detail, including a closer look at the company’s valuation as well as how they compare to public peers, so make sure to hit the subscribe button for more insights!

Note: The company reports its financials in SEK, and I typically don’t convert them to USD in my posts. For easier reading, you can approximate the USD value by dividing the reported figures by 10.

The Klarna story

Founded in 2005 in Stockholm, Klarna began as a challenger to traditional financial services, offering an innovative solution to make online shopping smoother. The mission was simple: to reinvent the invoice, allowing consumers to buy and receive their products now and pay later without all the friction associated with typical payment options. Initially, nobody believed in the idea—Klarna pitched it to business angels, but they couldn't understand why anyone would prefer to pay an invoice over traditional debit and credit cards. Fast-forward almost two decades, and Klarna has transformed into one of the largest fintech companies globally, now preparing for its next big move—an IPO in the United States.

The Journey from a Swedish Start-Up to a Global Fintech Giant

Klarna’s transformation from a small Swedish startup to a global fintech powerhouse is a testament to its relentless innovation, strategic partnerships, and unwavering resilience. Initially focused on Sweden and later expanding across Europe, Klarna quickly became a preferred payment solution for online shoppers. What’s less widely known is that Klarna achieved profitability within just a few years of its founding. However, as the company shifted gears to invest heavily in growth and global expansion, its financial trajectory followed a classic J-curve, temporarily dipping before setting the stage for long-term profits.

The company acquired Sofort for $150m to enter Germany, one of the largest markets in Europe. Before the acquisition, they tried to enter themselves, which proved difficult. With Sofort they 14 European markets right away, connecting more than 40,000 merchants.

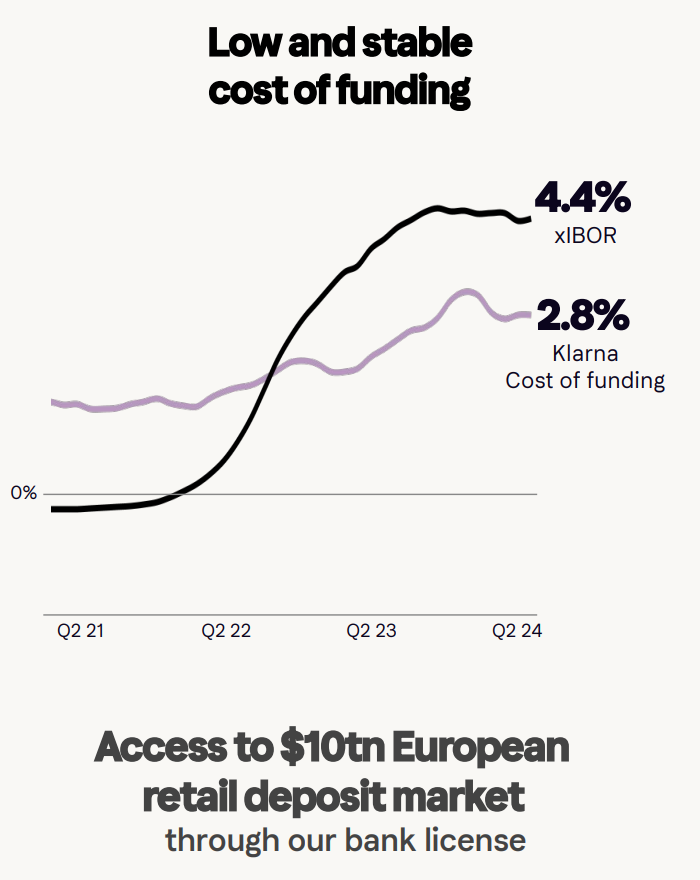

By 2017, Klarna had achieved a significant milestone by becoming a fully licensed bank, paving the way for its ambitious expansion into the U.S. market—a venture that brought both challenges and immense opportunities. In the years that followed, Klarna looked to grow through a series of acquisitions. Notable deals in 2020 included Moneymour, an Italian BNPL startup, and the acquisition of PriceRunner, which marked their largest transaction to date at $1.05 billion, a deal that many came to question later on. They also acquired a company called APPRL, which transformed into Klarna’s Creator Platform, which seems to have received little love by their product teams since.

In 2022, Klarna faced a dramatic shift in investor sentiment, marking a pivotal moment in its history. The company raised $800 million at a valuation of $6.7 billion—a staggering 85% reduction from its previous $46 billion peak. This steep valuation haircut signaled a significant inflection point, forcing Klarna to reevaluate its strategy and refocus its priorities.

I’ll dive deeper into the events surrounding this turning point and its broader implications for Klarna in future posts. For now, it’s clear that 2022 wasn’t just a financial reset—it was the beginning of a transformative chapter for the company.

As of today, Klarna has built a massive network of 575,000 merchants and tens of millions of consumers. The network effect is central to its strategy—as more consumers use Klarna, more merchants want to offer it, and vice versa. Notably, Klarna has formed partnerships with high-profile brands, such as Apple, Google, H&M, and Airbnb, helping it become a significant player not just in Europe but in the highly competitive U.S. market.

Overcoming Challenges: Restructuring and Refocusing on Profitability

Over the past two years, Klarna faced challenges common to many tech companies—rising interest rates, inflation concerns, and investor demands for profitability over growth. Klarna made the hard decision to restructure and focus on core profitability, divesting non-core assets like Klarna Checkout (sold to Kustom for $520m, a team of bond- and equity investors and a small team from Klarna) and leaning into automation and AI to improve efficiency. According to Sebastian Semiatkowski “90% of Klarna staff are using AI daily” and the impact is clear.

In 2023, Klarna reported a substantial cost reduction of 15%, partly due to restructuring efforts. The company also laid off 10% of its workforce to streamline operations and they managed to cut back 25% on marketing agency costs by using AI instead. These decisions were difficult but necessary to pivot toward sustainable growth and profitability, and as an investor, I find this a potential moat for which we might see a premium valuation long-term.

Q3 2024 Results: A Return to Profitability

Klarna's recent quarterly report shows that these moves are paying off. For the third quarter of 2024, Klarna reported a net income of SEK 216 million, marking its second consecutive profitable quarter—a significant turnaround from previous years of losses. Gross merchandise volume (GMV) was up 16% year-over-year, driven largely by 33% growth in the U.S., which has quickly become Klarna's largest market.

Total revenue rose by 23% to SEK 20 billion for the first nine months of 2024, showcasing growth across key metrics. In particular, revenue from the U.S. grew by 38%, reflecting Klarna's successful expansion in this highly competitive market. Adjusted operating expenses (excludes restructuring and share-based expenses) dropped by 2%, while the adjusted operating margin improved to 8%, reflecting effective cost management and operational leverage.

Revenue Channels and Cost Structure: How Klarna Makes Money

I had to dig into the quarterly reports to find more information about revenue channels since the P&L lacks a lot of details. In my upcoming posts, I will try to find more specific numbers such as revenues by channel and more, feel free to reach out if you have good sources!

Transaction and service revenues: Commission Income

Klarna charges merchants a fee for offering its payment solutions. Merchants benefit from increased conversion rates and higher average order values, which makes Klarna's service attractive. These fees form a significant portion of Klarna's revenue, accounting for approximately 84% of total revenue for the first nine months of 2024.

Commission income grew by 30%+ yoy generated by the network of 575,000 merchants globally and increased consumer engagement. Klarna reported that their take rate increased in the first half of 2024 from 2.33% to 2.54% but I don’t expect them to be able to increase this significantly with the current product suite, it would require other transaction types since payment fees are generally under pressure.

Transaction and service revenues: Value-Added Services

Klarna has expanded its value proposition by offering merchants additional services like marketing and advertising solutions. By leveraging its extensive data and insights, Klarna helps merchants effectively target audiences and drive sales. Notably, Klarna's marketing revenue has surged by an impressive 276% over the past two years and is said to make up around 1-2% of total revenues. It does showcase their effort to diversify beyond traditional payment processing and Buy Now, Pay Later (BNPL) offerings.

Transaction and service revenues: Consumer Fees:

This channel also opens up for adding additional products such as cards or a wider array of investment products, similar to the playbook of AFRM 0.00%↑, SOFI 0.00%↑ and others. Klarna already launched a consumer card and seems to have a roadmap for developing their consumer offer.

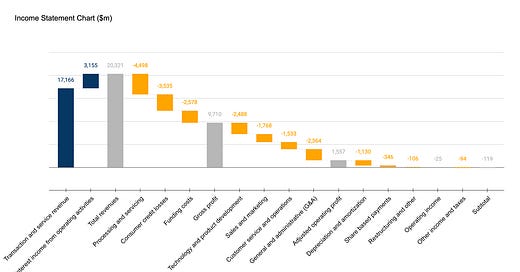

What it costs to run Klarna, and how they account for it

Cost of Goods Sold (COGS) are referred to as Transaction Costs: Includes payment processing costs, credit losses, and funding costs. Klarna's COGS primarily includes the costs associated with financing transactions, such as interest expenses paid on borrowed capital used to finance consumer purchases. In Q1 2024, credit losses rose by 59% to SEK 1.2 billion, primarily due to U.S. expansion. which has led to concerns among investors who are afraid Klarna is onboarding the wrong consumers. However in Q3 credit losses were stable at 0.46%, showing effective risk management. Funding costs are fairly low, and they have grown their deposits allegedly to SEK 106bn in Q3 2024.

Another noteworthy aspect of Klarna's financial performance lies in its outstanding balances relative to GMV (Gross Merchandise Volume, the total value of all payments processed). Klarna has demonstrated an ability to scale GMV maintaining a relatively low outstanding balance. The key driver behind this is Klarna’s 40-day average loan portfolio duration, which enables a much faster turnover of its balance sheet compared to competitors like Affirm, whose loan durations typically range between 3 to 12 months. This shorter cycle gives Klarna a significant advantage in managing liquidity and mitigating risk.

Operating Costs: includes technology development, sales and marketing, customer service, and SG&A costs. The company's R&D with a focus on AI has helped streamline operations, reducing customer service costs, another operating cost, by 20%. The company got a lot of media attention when it fired hundreds of support agents and kicked out outsourced call centers, which suddenly made the stock price of Teleperformance, a call center company drop by 14%. Marketing is a significant expense, as Klarna invests heavily in brand awareness and customer acquisition. However, with AI-driven efficiencies, marketing costs have been reduced by 25%, contributing to improved profitability. The company says they are heavily reducing SaaS licenses and replacing functionality with AI. They have even kicked out Salesforce, their CRM system, which is notoriously difficult to shift.

Klarna's P&L shows progress, but cost discipline remains key while maintaining growth

In summary, Klarna is making notable strides across its P&L, driven by top-line growth and a reduction in operating expenses. While the company faced higher credit losses in Q1 2024—a key area to monitor for any long-term analysis—its performance in Q3 showed stabilization, suggesting a positive outlook for gross margins moving forward. On the cost side, I find Klarna highly advanced in leveraging automation and operational efficiency, which is an encouraging sign for its scalability and future profitability, perhaps this is the part I am mostly excited about.

At first glance, a strong IPO candidate

Looking forward, Klarna's IPO in the United States will mark a new chapter. With partnerships that include Worldpay, Apple Pay, Adyen, and Google Pay, Klarna is positioning itself to become a default payment option across both online and offline channels, and they have clearly done their work to dress up the company for their big day.

However, I will have to look into more details, such as the valuation and how they compare to public peers before I decide to invest in their IPO. I will cover this and more in my upcoming posts, make sure to join me!